The Future of Live Events and Sports

Update #31 — October 20, 2021

In our 31st update to the “Future of Live Events & Sports: The Re-Emergence of Fans Post Covid-19”, we track how our framework for understanding Fan Demand is impacted based on market-specific factors, venue initiatives, and fan avidity. We have sifted through all the noisy data to bring you insights on how live events and sports will be different because of the COVID-19 pandemic.

In this update, we explore:

- Stabilizing KAGR Fan Demand Index as recent confirmed cases drop, and consumer behaviors rebound

- Fan demand trends and markets most impacted, including New York City, San Francisco, Washington D.C., and Houston

Market Analysis

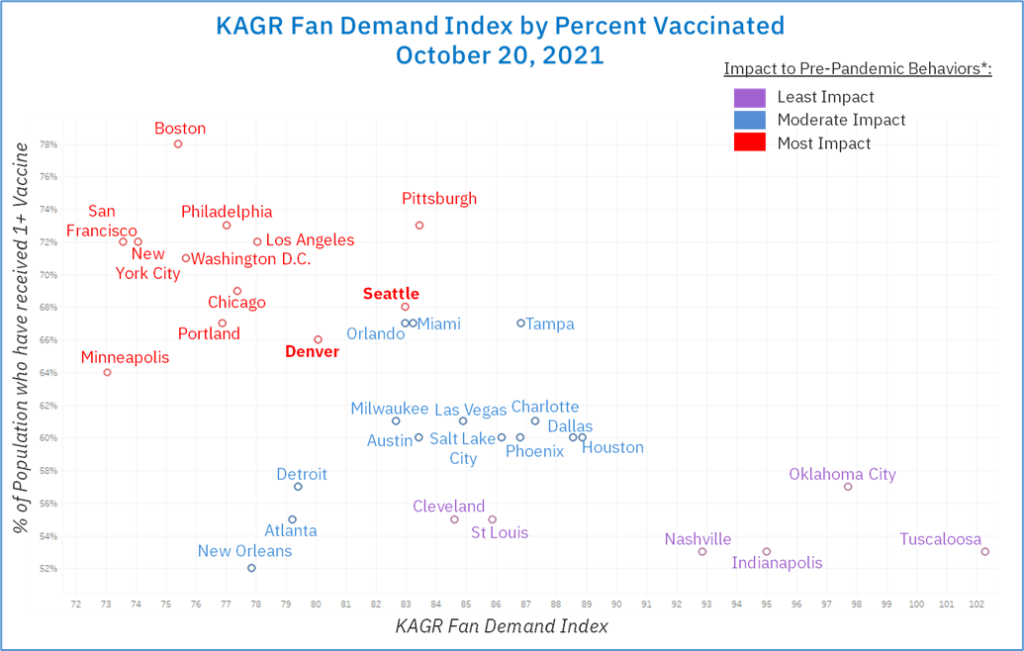

The KAGR Fan Demand Index remained relatively flat (<1%) report-over-report. New Orleans (+6%), Miami (+3%), and Nashville (+3%) all experienced small increases with Houston (-5%) and Seattle (-5%) seeing slight setbacks.

On average, recent confirmed COVID-19 cases dropped 18%, driven by Tuscaloosa (-52%) and Florida markets (-50%). In particular, Orlando, Tampa, and Miami saw COVID-19 decreases as a result of improved state vaccination rates and “temporary immunity” stemming from past infections. In several markets the impact of the delta variant remains, contributing to rising cases in Minneapolis (+38%), Detroit (+28%), and Denver (+17%). Vaccination rates have plateaued, with the eligible market population (with at least one shot) up 1.6%; this is the lowest week-over-week increase since vaccination rollout began in early 2021.

Consumer and economic indicators remained largely unchanged with one exception; dining and entertainment activity rose 7%. New Orleans saw a significant increase in restaurant reservations (+58%) as the city recovers from Hurricane Ida.

We continue to examine the impact of the pandemic on go-forward fan demand and behaviors. This week Denver and Seattle both jumped back to Most Impact, after only one week at Moderate Impact:

- Denver’s shift back to Most Impact was driven largely by an increase in recent confirmed COVID-19 cases (+17%) and a slight setback in airport activity (-3%).

- 1,000 new cases amongst students occurred within the last three weeks, as well as outbreaks in nearby jails. Although Denver requires face coverings in these and other high-risk settings (e.g., public transportation, hospitals, homeless shelters), there are no other mask mandates in-place.

- The city’s recent vaccine mandate for public employees received significant backlash, including 27 resignations/retirements.

- In contrast, restrictions have remained in place in Seattle, requiring masks for indoor public settings and any outdoor gatherings greater than 500 people, with additional guidelines announced for later this month. While recent confirmed COVID-19 cases experienced a small drop (-11%), both dining and entertainment activity and airport also fell back (-1%), with additional decreases expected.

- The Seahawks, Kraken, and more than 150 restaurants require proof of vaccination or a negative test in order to enter.

- This guideline will be extended to most indoor activities (e.g., restaurants, movie theaters, gyms) starting October 25th.

Fan Avidity at a Glance

We continue to collect, analyze, and test the KAGR Fan Demand Index against a variety of publicly available data sources.

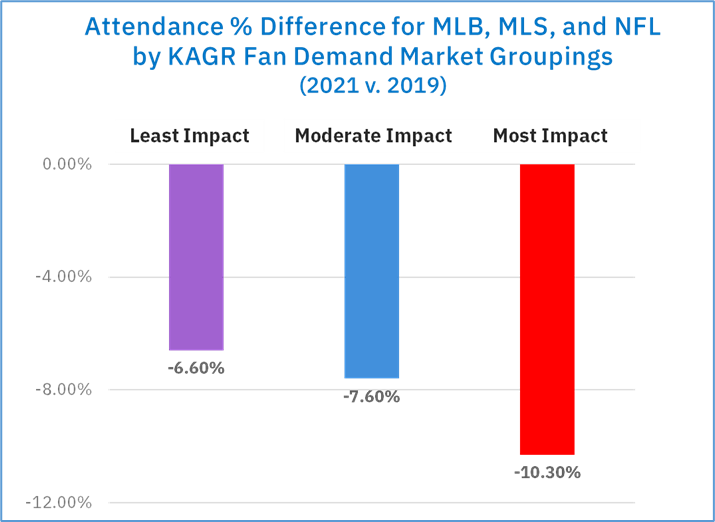

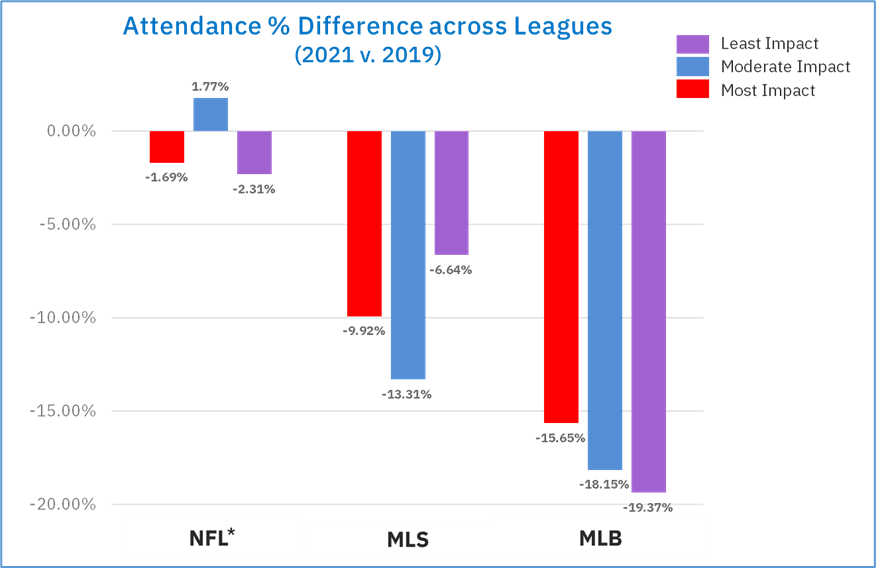

Fan avidity, as measured by attendance, is most significantly impacted in the Most Impact markets when comparing the 2021 season for MLB, MLS, and NFL to the same time period in 2019. The most impacted market of that group is New York City (-24%), followed by San Francisco (-19%) and Washington D.C. (-17%).

* Excludes New Orleans Saints Week 1 from Moderate Impact due to relocation to Jacksonville

*Source: https://www.sports-reference.com/

At the league level, MLB finishes the regular season with the largest decrease from 2019 (-18%), followed by MLS (-10%). Some league-specific highlights include:

- NFL:

- Two clubs are driving the slight increase in attendance in 2021 across Moderate Impact markets: Tampa Bay Buccaneers (+24%) and Dallas Cowboys (+10%); removing Tampa Bay results in a 1% decrease amongst the Moderate Impact markets. The Houston Texans have seen the biggest relative impact in 2021 (-6%).

- 3 out of 4 markets in the Least Impact market group have seen declines, with Detroit Lions (-11%) experiencing the greatest setback. The Tennessee Titans (+5%) is the one club to see a positive increase according to publicly report attendance data.

- MLS:

- The Moderate Impact market grouping saw the biggest aggregated impact amongst MLS clubs (-13%); Orlando City SC (-28%) and Houston Dynamo FC (-23%) were among the lowest. In general, Houston continues to drop back on KAGR Fan Demand Index (-5% report-over-report).

- Of the Most Impact markets, both New York City clubs have been significantly impacted this season (New York City FC, -68%, and New York Red Bulls, -17%).

- MLB:

- 9 out of 30 clubs have less than 50% attendance in 2021, with the Arizona Diamondbacks experiencing the greatest season-over-season drop (-51%).

- Like the NFL, this week’s Least Impact markets experienced the greatest overall decline (-19%). The Cleveland Indians (-22%) and Milwaukee Brewers (-17%) are amongst the lowest in that market group.

VIEWERSHIP SHOWS SIGNS OF REBOUND FROM 2020 DROPS

While in person attendance continues to be a challenge for leagues and teams, there are some bright spots when it comes to viewership.

- NFL viewership through October 4th was up 17% from last year and Monday Night Football ratings are up 24% from last year, and 26% from 2019.

- The WNBA also enjoyed a sizable increase in viewership this season, up 51% from the 2020 regular season, and most viewed WNBA season since 2008.

- The MLB Wild Card Game between the New York Yankees and Boston Red Sox was the most watched game on ESPN since 1998, averaging 7.7 million viewers. The AL Wild Card game was also up 67% from the Tampa Bay Rays and Oakland Athletics game in 2019.

With event attendance expected to be impacted for some time, overall engagement through viewership and other digital channels is a much-needed boost for leagues and teams. Fandom is strong – teams and leagues need to effectively find and engage these dynamic customer bases. Opportunities to leverage technology and innovation with a data driven strategy will be critical.