The Future of Live Events and Sports

Update #32 — November 30, 2021

In our 32nd update to the “Future of Live Events & Sports: The Re-Emergence of Fans Post Covid-19”, we continue to track how our framework for understanding Fan Demand is impacted based on market-specific factors, venue initiatives, and fan avidity. We have sifted through all the noisy data to bring you insights on how live events and sports will be different because of the COVID-19 pandemic.

In this update, we explore:

- Impact of COVID-19 surges in the Midwest and lasting consumer trends across markets

- Early season fan trends across the NBA and NHL

- Surge in NFT engagement and activity with several sports teams, leagues, and industry players now involved

Market Analysis

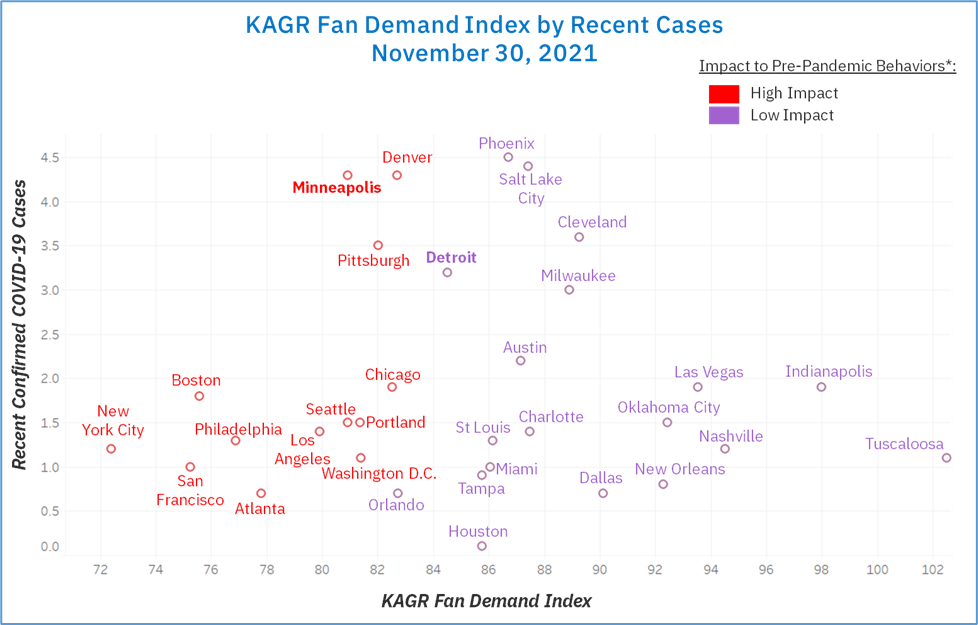

The KAGR Fan Demand Index remained relatively flat (<1%) report-over-report. Los Angeles (+5%), experienced the greatest increase while Denver (-3%) had the greatest setback. We are keeping a close eye on Omicron and potential impact given worldwide concerns.

On average, confirmed COVID-19 cases dropped 5%, driven by Houston (-91%) and Dallas (-63%). 16 markets saw increases led by Minneapolis (+87%), Detroit (+81%), San Francisco (67%), and Denver (+65%). Vaccination rates continue to increase, with the eligible market population (with at least one shot) up 2.8%; the highest report-over-report increase since August. With vaccine approvals issued for children 5 and older, we are closely tracking the impact.

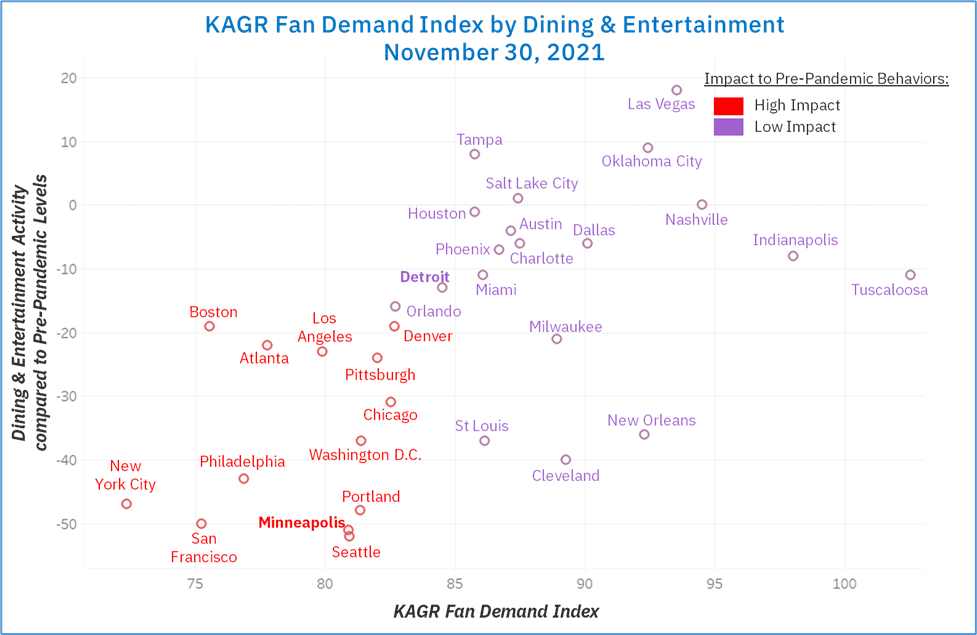

Consumer and economic indicators fluctuated across markets. Consumer behaviors increased by 2% with New Orleans (+8%), Tuscaloosa (+6%), San Francisco (+3%), and Miami (+3%) leading the way. Dining and entertainment dropped by 5%; Cleveland (-22%) and Denver (-18%) were among the markets most impacted.

We continue to examine the impact of the pandemic on go-forward fan demand and behaviors and delineate markets with the Most Impact, as measured by the percent change from pre-pandemic levels, from those with the Least Impact.

This week we examine shifts in two markets – Minneapolis moved to the Most Impact grouping and Detroit teeters on the edge of the Least Impact group as COVID-19 cases in both Minnesota and Michigan surge:

- Minneapolis has seen significant COVID surges over the past month:

- The KAGR Fan Demand Index fell back 2% on the heels of an 87% increase in recent confirmed COVID-19 cases and 36% increase in percent positive tests.

- COVID-19 cases over the past month have equated to the market’s 4th surge since the start of the pandemic and the highest per capita numbers since January 2021.

- Detroit experienced a large increase in COVID-19 cases in the last two weeks (+81%) with Michigan overall up 59%, resulting in a formal public health advisory on the use of face masks across the state. The impact on KAGR Fan Demand Index has been minimal (-1%) to date; however, consumer behaviors (-2%) and dining and entertainment activity (-5%) has started to decline with additional impact expected after the holiday weekend.

We also look at KAGR Fan Demand Index against the percent change in Dining & Entertainment Activity compared to pre-pandemic.

- 5 markets are currently experiencing activity above pre-pandemic levels; the greatest increase is Las Vegas (+17%) followed by Oklahoma City and Tampa (both +8%).

- Seattle (-52%), Minneapolis (-51%), and San Francisco (-50%) continue to experience the greatest setback; Seattle has 30% less restaurants open than before the pandemic.

Fan Avidity

With the NFL deep into its 2021 season and the 2021 winter seasons underway, we explore fan demand and engagement trends across attendance, viewership, and NFT activity.

NBA & NHL EARLY SEASON TRENDS

With a full month of games completed in the 2021 season, attendance for the NBA and NHL are out to a stronger start than 2020 (compared to the limited capacity venues) but still running behind 2019.

- NBA has seen an average attendance rate of 85% across clubs, compared to 94% in 2019. This is up from 82% for the reduced capacity 2020 season.

- NHL is slightly ahead of the NBA, with an average attendance rate of 86% (compared to 94% in 2019), and up from 74% in the COVID capacity 2020 season.

- While in-venue demand is below pre-pandemic levels, NBA viewership has seen positive momentum especially among key demographics, up 28% across the 18-49 age group and up 26% amongst women.

NFT TRENDS

NFTs burst on the scene in 2021, with over $14.3 billion issued1 and 412,000 active wallets to-date2. As such, sports teams, leagues, and industry players have been eager to join in on the action. As of September, sports-related NFTs have made up approximately 7% of the market (~$1 billion), with little indications of slowing3. Sports NFTs have been taken to market through a variety of mediums, including:

- League-level partnerships, such as the NBA (Dapper Labs), NFL (Dapper Labs / Ticketmaster), MLB (Candy Digital), and La Liga (Sorare).

- Team-specific deals, such as the New York Islanders and Orange Comet.

- Player-specific launches like Tom Brady’s Autograph, which has brought on legends including Tiger Woods, Wayne Gretzky, and Derek Jeter.

Despite the high volume of entrants, NBA Top Shot has dominated the sports segment with over $660 million in 2021 sales (January-July). Comparatively, the next closest competitor is Sorare, whose international presence has yielded a little over $70 million to-date (January-July)4. That said, the future looks bright for newcomers as 1 in 5 sports fans have invested in NFTs with an average spend of $600 per collectible5. Even one of the most recent entrants, Ticketmaster, has generated dramatic value for their “digital commemorative tickets”, with secondary market transactions going for thousands of dollars.

1 The market for non-fungible tokens is evolving (The Economist, October 2021)

2 Non-Fungible Tokens Quarterly Report (NonFungible.com, October 2021)

3 NFT Statistics – Sales, Trends, and More (Influencer Marketing Hub, September 2021)

4 TokenInsight 2021 Q2 & July NFT Industry Report (TokenInsight, July 2021)

5 How do sports fans feel about NFTs? (Bonusfinder, June 2021)

Looking Ahead

In the coming months, KAGR will kickoff a new series to better understand the key factors that drive attendance, looking beyond COVID-19 to examine the importance of considerations including cost of attendance, strength of schedule, stadium experience, and unique offerings. We believe that the pandemic has fundamentally changed the importance and impact of these factors. Leagues and teams will need to recalibrate their current strategies to optimize in-venue demand and attendance.