The Future of Live Events and Sports

Update #34 — February 11, 2022

In our 34th update to the “Future of Live Events & Sports: The Re-Emergence of Fans Post Covid-19”, and on the eve of Super Bowl weekend, we continue to track how our framework for understanding Fan Demand is impacted based on market-specific factors, venue initiatives, and fan avidity. We have sifted through all the noisy data to bring you insights on how live events and sports will be different because of the COVID-19 pandemic.

In this update, we explore:

- Omicron’s impact on KAGR Fan Demand Index

- A new multi-part analysis to identify and analyze factors beyond COVID-19 that impact attendance – this week we evaluate the cost of attendance in the NFL

Market Analysis

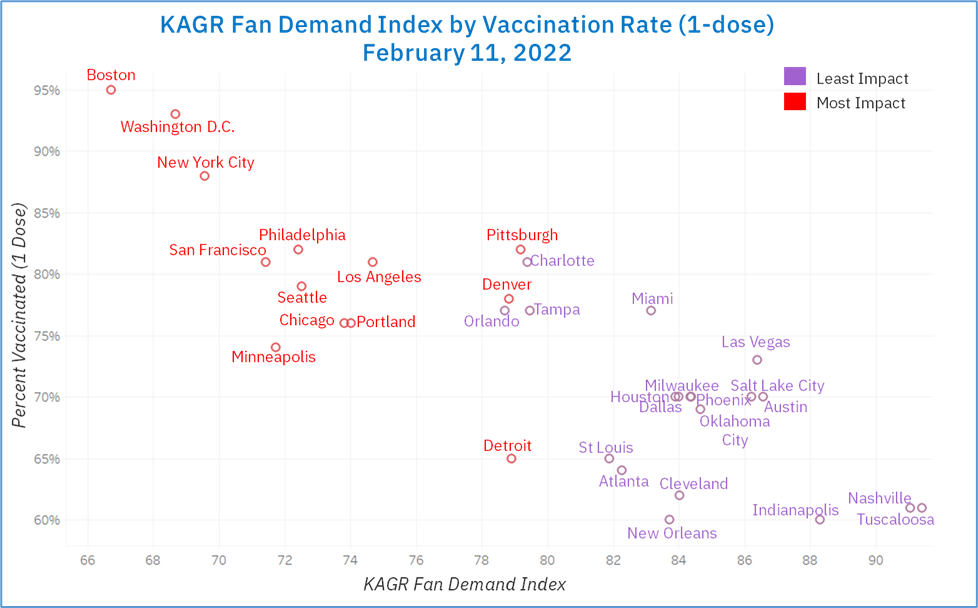

The KAGR Fan Demand Index jumped up 12% this week after a 17% drop in early January due to the Omicron surge. New York City (+78%), Miami (+50%), and Atlanta and Boston (both at +25%) experienced the largest increase. Minneapolis (-6%) was the only market to see a KAGR Fan Demand Index decrease over the past month.

On average, recent confirmed COVID-19 cases decreased by 55% (after a 550% increase between late December and early January), driven by New York City (-91%), Cleveland (-89%), and Washington D.C. (-87%). 4 markets saw increases over the same time period led by Oklahoma City (+221%), Phoenix (+22%), and Minneapolis (+5%). Vaccination rates continues to increase, with the eligible market population (with at least one shot) up 3% in January.

Consumer and economic indicators fell back across markets. Consumer behaviors decreased by more than 2% with Boston (-15%), New York City (-13%), and Orlando (-11%) experiencing the largest setback. Dining and entertainment also dropped 4% on average with Boston (-43%) and Minneapolis (-35%) seeing the largest decrease.

We continue to examine the impact of the pandemic on go-forward fan demand and behaviors. We delineate markets with the Most Impact, as measured by the percent change from pre-pandemic levels, from those with the Least Impact. As the lights shine bright on Los Angeles this weekend, we saw a 33% drop in recent confirmed COVID-19 cases with dining and entertainment up 21%, increasing overall KAGR Fan Demand Index by 20%.

Fan Avidity at a Glance

With the Super Bowl just days away, the Olympics entering its second full week, and the Omicron surge on the down swing we are tracking several stories and trends to further understand fan demand, interests, and avidity.

- Earlier this week Super Bowl 56 set records for the most expensive ticket, with an average of $18,600 and cheapest at $4,824. As kickoff time draws closer, the average get-in price is now below $3,500, pointing to potential delays in local fan purchases.

- Concern remains for how returning music events will fare in 2022 – a recent study shows music fans are cautious in buying tickets for upcoming shows, only 9% of music fans surveyed (out of 2000) indicate they have bought concert tickets over the last 12 months, down from 25% in 2019.

- With the second games in six months and a challenging time zone difference, viewership for the Beijing Olympics games continue to wane, down more than half from the 2018 games in PyeongChang.

- The men’s World Cup opened its ticket application process last month with 1.2 million applications received in the first 24 hours and 17 million in total through the first application window. Ticket prices for the finals next December is up 46% from four years ago.

COST OF FAN ATTENDANCE – NFL SPOTLIGHT

In our last issue, we introduced a new series highlighting the impact of several factors, including cost of attendance, on both fan demand and in-venue attendance. We examined MLB, identifying a meaningful impact of rising Fan Cost Index (FCI) on attendance[1] rates.

This issue, we look at the NFL and explore whether this trend is similar across other leagues. KAGR collected several pieces of publicly available data across the 2019 and 2021 seasons including attendance (measured as tickets distributed), club and stadium specific factors, and the Fan Cost Index. To break our analysis down further, we look at fan cost of attendance at a league, region, and club level.

League Level:

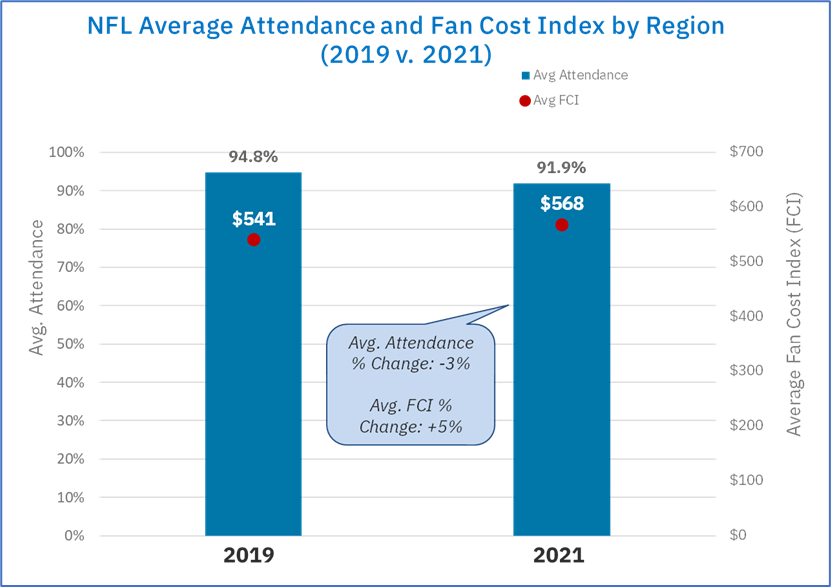

At the league level, attendance dropped 3% from 2019 to 2021, while the average cost of attendance across the league increased by 5%. In comparison, MLB saw attendance decrease by 16% and average cost of attendance increase by 7%.

Region Level:

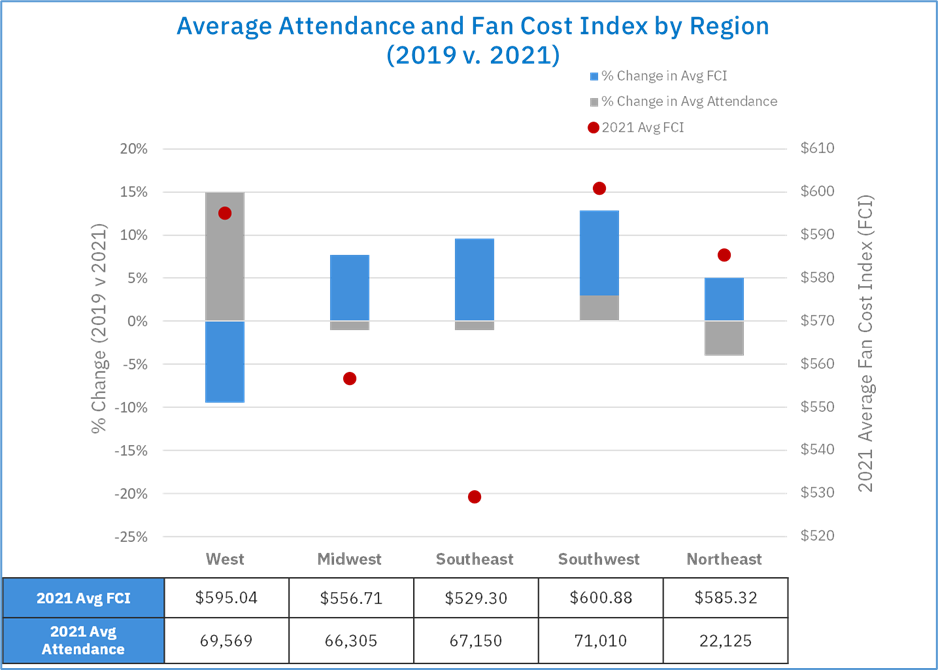

* Regional breakdowns include:

- Midwest (MW): Denver Broncos, Chicago Bears, Detroit Lions, Minnesota Vikings, Kansas City Chiefs, Cincinnati Bengals, Cleveland Browns, Green Bay Packers

- Northeast (NE): Baltimore Ravens, Washington Football Team, New England Patriots, New York Giants, New York Jets, Buffalo Bills, Pittsburgh Steelers, Philadelphia Eagles

- Southeast (SE): Jacksonville Jaguars, Miami Dolphins, Tampa Bay Buccaneers, Atlanta Falcons, Carolina Panthers, New Orleans Saints, Tennessee Titans

- Southwest (SW): Arizona Cardinals, Las Vegas Raiders, Dallas Cowboys, Houston Texans

- West (W): Los Angeles Rams, Los Angeles Chargers, San Francisco 49ers, Seattle Seahawks

At the regional level, we see relatively consistent increases in FCI across the Midwest, Southeast, and Northeast with limited impact to attendance. Both the West and Southwest regions show some exceptions – driven by two clubs, the Los Angeles Chargers and the Las Vegas Raiders, as they settled into their new homes in 2021.

- The Los Angeles Chargers greatly impact the West region findings. In the 2021-2022 season, the Los Angeles Chargers experienced a 30% decrease in FCI and a whopping 100% increase in attendance. In 2019, the Chargers played at the Dignity Health Sports Park (formerly StubHub Center), a 30,000 seat stadium in Carson, CA, while Sofi was under construction.

- In the Southwest region, we see both an increase in FCI and attendance. The Las Vegas Raiders alone saw a 58% increase in FCI as they opened their doors this season to Allegiant Stadium and a resulting increase in attendance of +16% compared to the Oakland Coliseum in 2019.

Specific NFL Club Analysis:

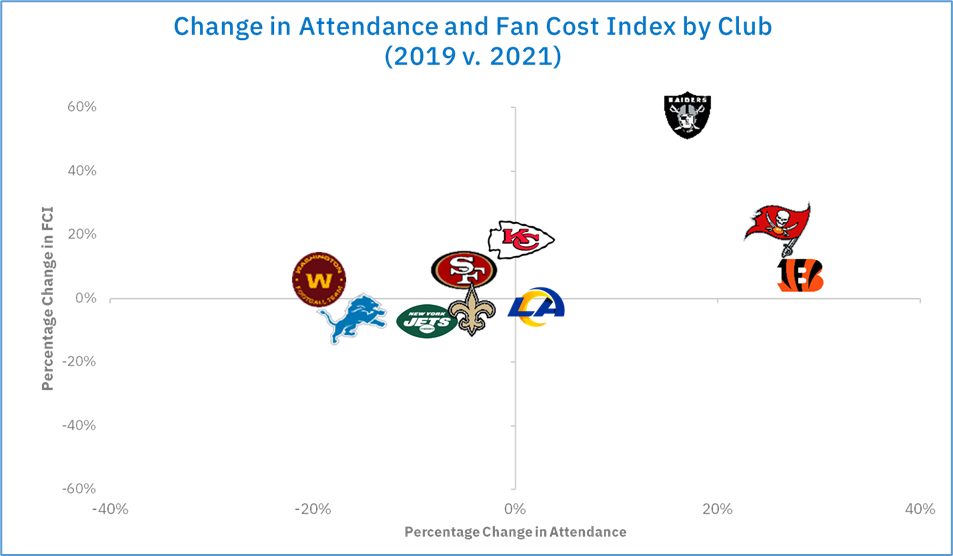

We selected ten clubs to compare across conferences and markets, representing a mix of regions, club performance, and historic fan avidity:

- On average, these clubs increased their FCI by 8% and saw an increase in attendance of 12%.

- 3 Teams saw both an increase in their FCI and attendance, led by the Las Vegas Raiders (+58% FCI, +16% attendance), Tampa Bay Buccaneers (+25% FCI, + 27% attendance), and Cincinnati Bengals (+8% FCI, +28% attendance).

- 4 Teams increased their FCI and saw a decrease in attendance, most notably Washington Football Team (+7% in FCI and -19% in attendance) and the New Orleans Saints (+6% in FCI and -5% in attendance).

CONCLUSION

With MLB, we saw a more direct impact of FCI on attendance. However, there are still similar insights and trends across both leagues. We see the new stadium phenomenon with Allegiant and Sofi driving favorable results for their respective clubs, like the Texas Rangers. Also, increases in relative on field performance have fared well for both the Cincinnati Bengals and Tampa Bay Buccaneers, similar to the Chicago White Sox and San Diego Padres.

As we continue to look to other leagues, we seek to further understand factors beyond cost and the impact on attendance. Will team performance and venue renovations favorably impact attendance in the NBA and NHL? Has the pandemic changed the impact of season length and number of games on the fan’s willingness to attend?

[1] Attendance data for this analysis is defined as distributed tickets, publicly available through ESPN.com